Did work from home cost-cut or add to expenses? Let's deep dive to find out the ground realities.

Looking at the brighter side of the picture, the new normal working-from-home (WFH) has helped the salaried employees cost-cut on their expenses to a considerable extent. However, many are unaware of the fact that their tax liability will shoot up this fiscal year due to WFH. Though organizations and employees have quickly shifted the gears and adopted to the unprecedented change our tax laws could not catch up to this sudden transformation speed.

Businesses are conventionally structured to operate from workplaces, and hence the compensation structure and policies were accordingly formed. All the labour Regulations and Tax Laws were formulated to suit the traditional on-premise work environment.

However, this work-from-home was forced upon the organizations by this pandemic COVID-19 challenging the traditional tax laws drafted over the years.

Several benefits no longer remain relevant to employees as the work ecosystem sees a drastic shift in this current situation. In addition to the workplace benefits like free access to the gym, subsidized meals, shuttle services, crèche facilities, etc. employees are now deprived of many other perks and benefits.

What becomes taxable?

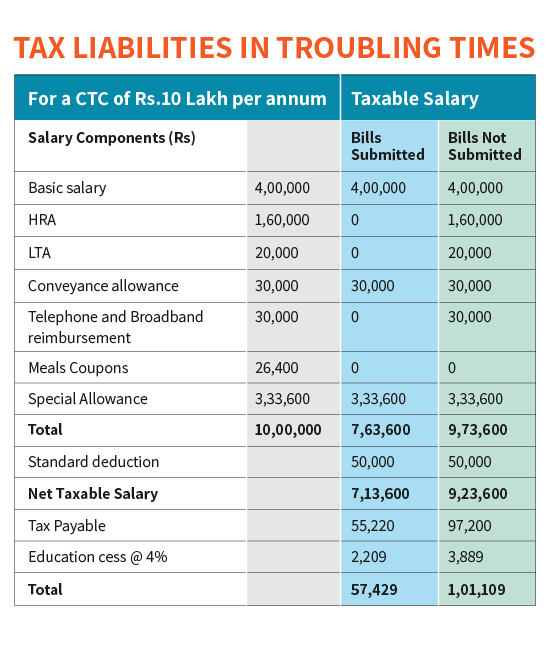

Because the employees are not traveling under the current situation, leave travel allowances, fuel reimbursements, conveyance allowances, and the uniform allowance has become fully taxable. These allowances are reimbursed and become tax-free only when the documents (bills, tickets) are produced as evidence of the actual expense incurred.

In this uncertain time, as we have no clear answer to “till when are we working remotely?” many employees have gone back to their native places vacating the rented accommodation. Hence claiming the House Rent Allowance (HRA) without the cost incurred would be taxable, directly impacting their take-home salary.

Taxable benefits

Responding to this crisis, employers are going out of their way to help their workforce adapt to this situation. Companies have declared a fixed amount as a work-from-home allowance to aid employees in setting up their home offices. Internet and electricity charges, office furniture, laptops, etc. are covered under this allowance and do not require the employees to produce bills for the same. But the catch here is, the amount will be taxable in the hands of the employees.

A salary includes all remunerations given to the employee either in cash or kind. The actual take-home amount depends on the specific exemption provided to the employees. Though the employers are extending their support to handle this business exigency, the tax liabilities may not let the employees enjoy these benefits to the fullest.

Nevertheless, mobile expenses and broadband charges are clearly exempted, but other benefits like office furniture and gadgets remain taxable under the present law.

The tax liability would depend on the ownership and how the benefit is given. For example, if the company provides a chair to the employee to work from home, the tax liability of 10% of the asset cost will be on the employer. On the contrary, if the employee is asked to buy the furniture and produce the bill for reimbursement, the liability would rest on the employee.

Experts are forecasting that the step taken by the government to replace allowance in the budget with standard deductions for the salaried class would ease out the work-from-home situation.

Here are a few relevant article for you to read:

Will work-from-home work for long?

Learning and development for employees during COVID

If you have enjoyed reading this article please share it.