Using Excel as a tool for payroll processing started when the other options were either:

- The enterprise software, which was too expensive or

- The old fashioned manual way with pen and paper

But today, it is safe to say that Excel is one of the most inadequate tools for payroll management.

Do you relate with the above scenario?

The decision to opt for spreadsheets usually rests on a few faulty assumptions, which are not usually backed by data.

Assumption: “Excel gets the job done.”

Reality: Countless payroll executives and the like, struggle with the application of row upon row of formulae and rules. One wrong click and the whole sheet goes for a toss. Accuracy is hit and penalties get slapped on the organization. In short, what results is utter confusion.

Assumption: “Excel is simple and suits my needs.”

Reality: This one's our absolute favorite! Organizations grow over time. Employee count increases and statutory compliances vary from region to region. This makes payroll processing more complex, time consuming and cumbersome as the head count and laws change.

Assumption: “Everyone knows how to use Excel.”

Reality: Processing payroll in Excel takes someone skilled. With all the formulae, VLOOKUPs, etc., it takes someone knowledgeable and highly trained about the functionalities and shortcomings of spreadsheets. Even if you are well trained, how many hours do you waste on manual and redundant work? According to a research2, 60% of companies that use Excel take seven or more days to process payroll.

Other common issues

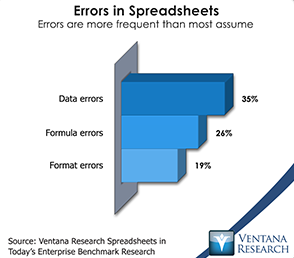

- Common Errors: Accoring to a research by The Wall Street Journal, 88% of the spreadsheets contains errors. The most common ones are data errors, such as copy-paste, formulae, format, etc., that crop up all the time on Excel and go unnoticed.

- Cost implications: Organizations may face penalties and financial losses due to wrong calculations and errors in spreadsheets. A simple error cost a big Canadian power generator company a whopping USD 24m3. SMEs can't afford to risk these kinds of errors, which can have adverse effects.

- Payroll Fraud: According to Forbes4, payroll fraud happens in 27% of all businesses and occurs nearly twice as often (14.2%) in small organizations with less than 100 employees. It's very important to have a centralized location for all the payroll-related information at one place, with access granted to only the stakeholders of the organization.

- Generating and distribution of payslips: As your organization grows, it gets increasingly complex and time-consuming to generate and distribute payslips from multiple files.

However, if you still prefer to continue payroll management with Excel, please ensure you follow these best practices:

- Ensure your spreadsheet is from a reliable source

- Check for accuracy and statutory compliance

- Keep your spreadsheets up-to-date

- Backup your data regularly

Alternatively, there's an easier, faster, highly efficient and value-for-money solution available on the cloud. With automated payroll management and other seamlessly integrated features.

Want to discover more?

Resources: