No payroll process is complete without performing its accounting activity, as compensation forms one of the major portions of an organisation’s expense. It is said that close to 50% - 60% of the total cost of an organisation is spent towards employee compensation and benefits, including statutory contributions. This is predominantly so in the non-manufacturing sectors, where the major expense is spent on human resources. Needless to say, it is essential to have a robust accounting procedure in place. A complete step-by-step procedure with appropriate checklists must be established with the sign-off from appropriate finance teams and internal auditors.

In a small and medium business the payroll function is typically performed by a member of finance team. At times a payroll specialist may also be hired for this job.

Payroll accounting is no different from other accounting principles.

It is split into two parts – (a) booking of the actual salary expense and (b) creating provisional or accrual entries in the books of accounts.

Booking the actual salary expenses:

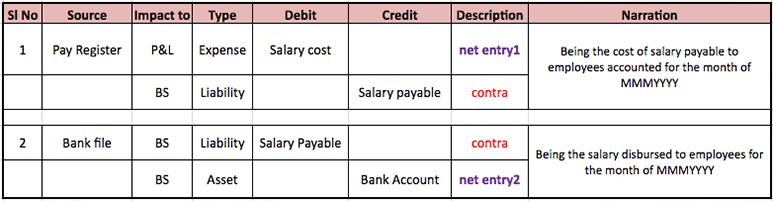

Akin to any other expense being booked in the books of accounts, we need to record the transactions of salary payout according to the monthly pay register. Such expenses will be booked as ‘Employee Salary cost’ in the Profit & Loss (P&L) account while the liability to pay will get recorded in the Balance sheet (BS) account under a control account generally called ‘Salary Payable’. Needless to say, any amount lying in the liability accounts must be paid out or is payable in the near future. This amount lying in the Salary payable account (BS) will get squared off when salary payment is actually made to employee at the end of the month and the corresponding bank payment entry is passed.

Illustration for booking salary costs:

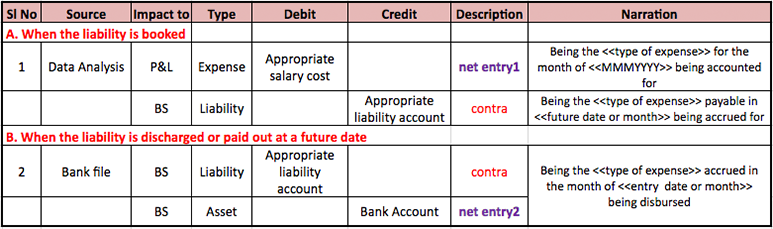

Booking the salary accrual expenses:

The second aspect of the accounting principle is to provide for futuristic salary expense or accrue for future liabilities for any unpaid wages or benefits that are liable to be paid but (a) have not been paid for whatever valid reasons (eg, Absconding employee, sudden death of employee, etc) or (b) they are not yet due for payment but needs to be paid in the future (eg. Gratuity, superannuation, insurance, bonus, incentive, etc)

To clarify further on the accruals, let us relate this to one personal scenario. Assume that you have taken an insurance policy for a premium of Rs.12,000 per annum and this payment is due in January of each year. Come January, you will have a huge cash outflow of this amount in addition to your monthly household expenses if these are not planned appropriately. However, in anticipation of this expense, you need to keep aside Rs.1,000 per month until you accumulate an amount to Rs.12,000 by end of the year.

That way, you will not feel the pinch of a huge cost in one single month.

Similarly, in a business scenario, there are multiple such expenses that may not be due currently but payable sometime in the future. This is what is called creating expense provisions or accruing of liabilities. Similar to salary payable account in the Balance Sheet, other such similar liability control accounts can be created.

Illustration of booking of accrual:

This is not only a good practice to follow but is a mandatory requirement as per GAAP. One suggested method to ensure we do not miss out on any accruals of income or benefit is to run a checklist on all pay elements from the wage catalogue by each line item and mark them as either paid out or yet to be paid. Those that fall under yet to be paid or payable will form the accrual for the month.

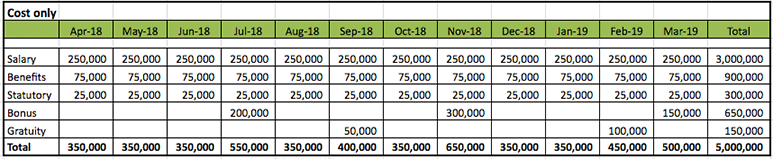

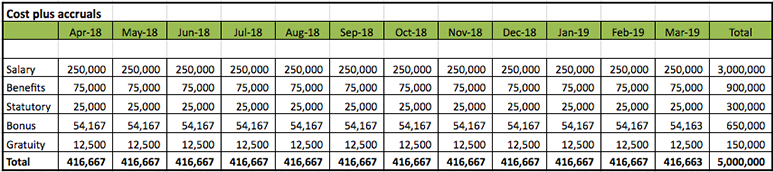

Illustration on how the Profit & Loss will look like if (a) only cost is booked and (b) cost plus accrual is booked.

You will notice from the first chart that the monthly total salary costs are so unsteady and unpredictable. To avoid this situation, booking of cost along with accruals on a monthly basis will help to evenly spread the expenses the whole year, as illustrated in the second chart.

Actuarial evaluation and related accounting entries:

Accounting Standards (AS-15) requires companies to accrue for employee liabilities such as Gratuity and all types of Leave encashment. With regards to gratuity, since the amount payable is dependent on last drawn salary at the end of service and also number of years served (minimum of 5 years or more only are eligible), it is difficult to predict both the exact values today. Similarly, with regards to leave encashment, it cannot be predicted how many leaves an employee would avail during the year or how many would be carried forward or encashed. Hence the guiding principles recommend a method called ‘Actuarial Valuation’. This valuation is purely based on certain assumptions, analysis of past data or parameters and is an approved method to accrue for these liabilities. The valuation is performed by specialists called ‘Actuaries’. The inputs for assumptions or parameters are generally provided by payroll officer to the actuaries. Once the accrual value is worked out & approved, the same needs to be booked under liabilities in the books of accounts.

Accounting entries in case of over payments or recoveries due from employees:

There are instances where an employee may get overpaid due to whatever reason or may end up in a negative salary due to excess of deductions over income. The excess amount or negative pay must be booked as salary advance in the name of the employee in the Asset side of BS under a control account generally called ‘Employee Recoveries’. Once the employee repays the same by way of cheque or bank transfer, then the entry will get nullified via the bank entry. If the amount is recovered through payroll then the amount will get nullified via the monthly payroll entry, as the case may be. In the event the amount so due from the employee is not recoverable due to any reason, the payroll officer must check for Company’s accounting guidelines for timely write-off of such aged recovery items & take appropriate action on a regular basis.

Reconciliation of payroll accounts:

Remember that the accounting activity is not over by merely posting journal entries in general ledger. Reconciliation and maintenance of payroll control accounts is still a responsibility of the payroll officer. In other words, reconciliation means any closing balance in any of the control accounts must be justified and explained or statement prepared to display break down of the closing balance by individual entries and amounts, along with supporting documents, if any on why such a liability is created in the books of accounts.

Example: Under normal circumstances, the salary payable account must show a NIL balance each month to state that the Company has paid salaries to all its employees and that it does not owe any outstanding salaries to any of its employees. However, for whatever valid reason, it has processed salary but not yet disbursed it to an employee or a group of employees, then the unpaid amount will appear as an outstanding liability in the salary payable account (control account in the BS). The payroll officer will provide a complete list of such employees who have not been paid and the reasons thereof as a part of the reconciliation.

The same principle and methodology should be applied for all such control accounts (eg. Gratuity, superannuation, insurance, bonus, incentive, etc) that have closing balances. Such reconciliations can be demanded by the management or auditors or government agencies at any point of time. Reconciled control accounts serves as a constant reminder to the pay master of what is due to be paid to whom and when. On the asset side, it will also serve as a reminder for collection of outstanding dues from employees, etc.

Automate monthly payroll cost booking:

Any robust or popular payroll software will support interface of salary cost entries with the Company’s finance software. As a one-time exercise, the salary data can be configured to convert it into accounting entries in order to record for salary costs (for all payouts), income (for any recoveries), assets (for any dues to Company) and liabilities (for any dues by Company including cost accruals). This will not only avoid time consuming manual posting of entries but eliminate the risk of errors or manipulation.