Numerous software systems in the market are made for either experienced users or newbies. At greytHR, we’ve designed workflows to suit both categories of users! Here’s a closer look at how processing payroll using greytHR is a breeze - whether you’re a veteran or a newbie.

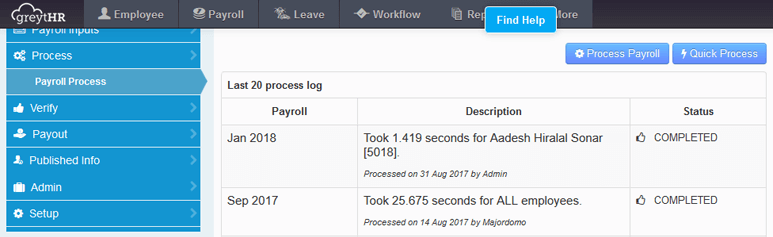

First, you need to navigate to Payroll > Process > Payroll Process within the product in order to be taken to a page where you can choose between the two abovementioned workflows. You can process payroll for the current month from this page.

As mentioned above, there are two pathways you can take from here, i.e., there are two ways in which you can perform the payroll process. You will be presented with two buttons on this page: Process Payroll and Quick Process.

- Process Payroll: If you click on the Process Payroll button, you will be presented with a checklist of all the items that you need to complete before you can process the month’s payroll.

- Quick Process: Quick Process, on the other hand, is for our more advanced users. Here, payroll processing will begin immediately without a checklist or any other verification processes.

1. Process Payroll: For users who are new to payroll

As mentioned above, clicking on the Process Payroll option will take you to a screen with a checklist of all the items you need to complete before you can process the current month’s payroll. The checklist ensures that all necessary activities are complete before you attempt to process the month’s payroll. The order in which they appear is the recommended order to complete the tasks, but not the mandated order.

-1.png)

Here is the full list of items on the checklist you need to complete before payroll can be processed using the Process Payroll option.

- Lock previous payroll: Locking the previous month’s payroll will ensure that it is not disturbed while processing payroll for the current month.

- New employee additions: Update information on all new employees using this option.

- Employee separations: Here, you can update information on all employees who have left the organization. Once marked as separated, they will not appear in your payroll.

- Confirmation updates: Employees who have been confirmed since the last payroll have to be specified here. In case of salary changes due to confirmation, update the same using the Revise Salary page.

- Employee data updates: Update any changes in employee data here, including changes in location, designation, department, etc. This information will be required for any salary components linked to them, such as professional tax which is linked to an employee’s location.

- Update payment details: There may be employees who joined in the previous month but have not yet provided you with their bank account details. The details of such employees and also those whose bank account details may have changed over the course of the previous month can be modified here.

- Salary revisions: For employees whose salaries have changed, ensure that salary details are updated using the Revise Salary page.

- Update one-time payments: Update one-time payments such as incentives, bonus and overtime wages here.

- Update one-time deductions: Update one-time deductions such as salary advance recovery, lunch deductions, etc., here.

- Update any other salary changes: There may be additional salary inputs to be updated. The relevant components can be updated here.

- Loans update: Here, you can update the software with information regarding new loans given to employees or make changes to existing loans and the associated terms, etc.

- Stop salary processing: Use this option to exclude those employees whose salaries need to be stopped. This may include employees who have absconded, those serving their notice periods or are on long unpaid leaves, etc.

- Update LOP/LWP: Update here the number of loss of pay (LOP) or leave without pay (LWP) days, that is, days when the employee was absent and the day’s pay needs to be deducted. There may also be cases where LOP reversal needs to be done. All this can be performed using this option.

- Update arrears: If there have been any salary revisions which are effective from a prior date, the arrears due will need to be calculated. With this option, you can be assured that arrear calculation has been initiated.

- Update full and final settlements: You can perform F&F (full and final settlements) as part of the month’s payroll or outside it for those employees marked as separated.

- Reimbursement claims: Ensure that the reimbursement claims submitted during the month have been reviewed. Only then will they be considered for the month’s payroll.

- Lock IT declaration: Ensure that IT declaration is locked so as to prevent employees from declaring this during the payroll process.

- Download IT declaration: Once IT declaration has been locked, it has to be downloaded so as to incorporate it into payroll. Ensure this is done.

Most of the items would require you to visit a different page. You can go to the relevant page by clicking on the Take Me There button. You will need to complete the task and return to the checklist.

Once you have completed each task, check-mark the relevant item and it will move to Completed Tasks. There may be some items that are not relevant to you. You can click on Ignore against these and proceed to the subsequent steps.

Once all the above items are marked as done, click on Process Payroll to complete the processing activity.

2. Quick Process: For advanced users

Here, payroll processing is a one-click activity which will result in the computation of all salary components, reimbursements, arrears, settlements and statutory components including income tax or TDS. Once processing is complete, you are now ready to start the verification and salary payout activities.

Payroll reconciliation tools

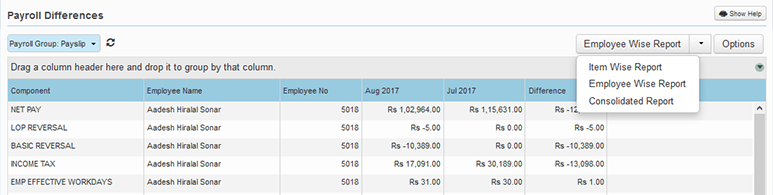

After the payroll process is complete, you will be shown a summary of the payroll along with a brief comparison with the previous month's payroll. Such a comparison is known as payroll reconciliation. It is the process by which the payroll department checks the current month's payroll, compares it against the previous month's payroll against the inputs received, and verifies them to make sure that the current month's payroll is calculated properly. This feature helps you eliminate discrepancies that may have crept into your payroll.

The payroll reconciliation report compares the salary register of the current payroll cycle with that of the previous cycle, verifies it component-wise as well as the total and vis-a-vis the net pay of employees so as to ensure that the current payroll is accurate. In case of any variation, the same will be recorded as Payroll Differences.

There are a number of other reconciliation tools on greytHR, such as Payment Type Reconciliation Report, JV Differences Report, and Headcount Reconciliation Report that will help you compare the current and previous month’s payrolls.

greytHR enables you to enjoy a smooth, automatic, and seamless payroll run. This leaves you free to concentrate on managing your core operations.