In the race to maximize revenue streams and acquire and retain more clients,payroll processing services have much to offer you. Here’s why it makes business sense to take up the activity.

Maximize revenue streams: If you aren’t offering payroll services, you may not be growing your practice to the fullest extent. Payroll offers a recurring revenue stream which helps maximize the revenue you earn from each client. Moreover, by not offering payroll services, you're putting off potential clients who want an all-in-one solution. This is costing you revenue.

Low-hanging fruit: Taxation, accounting and payroll are closely linked. These services are similar in nature and are handled by the accounts or finance team. Knowledge and credibility in delivering one of these services can easily lead to others in the same area, such as payroll, being offered to you.

Differentiation as competitive advantage: As a firm offering the complete range of financial services to your clients, you are able to differentiate yourself from competition and gain an advantage over other firms that may be seen as substitutes for yours.

Opportunity to offer your clients more: Payroll is a top priority for organizations. Errors and delays in payroll lead to a number of issues and are very costly as they lead to dissatisfied and unproductive employees. Business owners are looking for experts to help them process accurate and timely payroll. This presents an opportunity for you to help them.

Reduced risk: Your clients already trust you with their financial information. Between opening up their financial data to a new entity and trusting you with their payroll information, the latter poses a lower risk to your clients. Moreover, A single point of contact for all their financial needs - from accounting to payroll - means your clients will not have to worry about having to get their accountant and payroll processor to stay on the same page.

Cost savings: Combining the services you offer will save you money – and you can pass on some of these savings to your clients.

Opportunity for further collaboration: Taking on a client’s payroll process opens doors for further collaboration, i.e., the chances that the client may enlist for more services, such as financial planning and analysis, consulting, and more, rises. This means lower risk of lost clients.

Technology as an enabler: HR and payroll process software on the cloud enables you to process payroll for more clients per payroll executive you hire. Earlier, with spreadsheets, a single payroll executive you hired could process payroll for not more than two to three clients. The time taken to process payroll per client was also very high. Now, advent of cloud technology has increased your payroll executive’s productivity and efficiency along with the speed and accuracy of HR and payroll processes due to the software’s in-built automation.

The payroll software also throws up pre-built and customized statutory reports. This enables you to provide faster and more meaningful reports to your clients (not just payslips) that help them make better decisions.

From the horse’s mouth: Clients speak

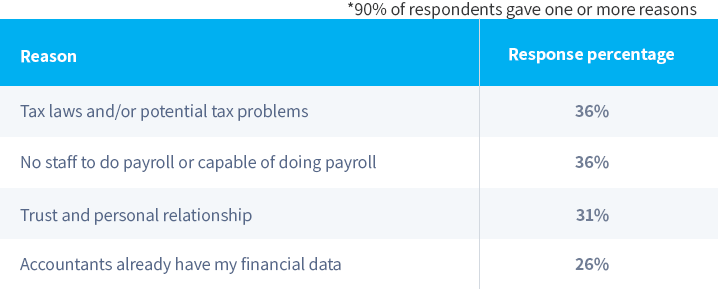

Few things are as powerful as hearing the reasons from the decision maker himself/herself. A survey conducted by the National Payment Corporation (USA) illustrates the top reasons why clients want to hand over payroll to their accountants:

Table 1: Why clients want their accountants to manage payroll

Cloud technology for payroll processing

Payroll is not what it used to be. Technology has transformed the activity from a low return and error prone affair to a highly automated and profitable one. Payroll software that’s on the cloud and integrated with other systems is not only the most advanced technology available today but also the one which has among the lowest TCO and fastest ROI.

Payroll software is reliable and accurate, unlike Excel which is prone to human error and involves much manual work. The reduction in manual work means faster process completion. This, in turn, frees up your employees time to work with new clients, thus aiding in business growth. What’s more, all compliance-related updates reflects in the software automatically, eliminating the pain of having to keep up with these changes.

Integrations with other systems such as the leave and attendance management systems mean data flows in from these into the payroll system in a seamless manner. This in turn means reduced errors, no duplication of work and reductions in manual effort.

greytHR: Your ideal technology partner

With greytHR as your technology partner, you can easily take up payroll processing.

greytHR is India’s largest provider of payroll solutions for small businesses. We cater to 4500+ clients and handle 7,20,000+ users daily. greytHR will enable you to easily and accurately process payroll for your clients. It offers:

- Complete salary calculation and payslip generation

- Reimbursement, arrears and final settlements

- All statutory calculations and reporting on PF, ESI, TDS and Professional Tax

Additionally, we will continuously keep you updated on all the changes that are happening to PF, ESI, TDS and Labour laws.

Being cloud-based, greytHR allows you to get started easily and with no upfront investments. Your opex will also be very low, with fees starting at Rs. 20 per employee per month.

What’s more, we will help you onboard your clients and get started easily and at no additional cost. Our support is rated the best, with more than 94% satisfied ratings across 4500+ clients!

If you are interested in setting up a payroll practice for yourself and would like more information on how to go about this, click the button now!